A panel of the Supreme Court on the Hindenburg report: “Prima facie does not find fault”

A six-member Supreme Court panel stated that it didn’t discover evidence suggesting that regulatory mechanisms had failed following a rise in Adani Group stock prices.

Supreme Court-appointed panel gave a clean chit to Gautam Adani’s Adani Group

A Supreme Court-appointed panel of experts that looked at data from the country’s market watchdog, the Securities Exchange Board of India, or SEBI, to look into allegations of financial fraud and stock price manipulation made by American short-seller Hindenburg Research in January gave Gautam Adani’s Adani Group the all clear on Friday.

The six-member panel added that the market is not “unduly volatile” and has not found any evidence pointing to the failure of regulatory mechanisms following the sharp increase in Adani Group stock prices.

SEBI: “No visible trend of manipulation”

The panel, which demanded that SEBI complete its own (independent) investigation as soon as possible, claimed that information provided by the regulator showed “no visible trend in tampering” in the market value of stocks of organizations operated by Gujarat-based business tycoon Gautam Adani.

“Principally, it couldn’t be feasible for the group of experts to determine that there was a regulatory error around the claim of price rigging at that point, taking into consideration the clarification given by SEBI (and) backed up by empirical data,” the panel wrote in its report.

The report, submitted at the beginning of this month, also stated, “Adani stock instability was indeed high, but this is due to the release of the Hindenburg report and its consequences.”

Report of the panel appointed by SC

According to the panel appointed by the Supreme Court, the sharp increase in stock prices could not be attributed to “any single entity or group of connected entities.”

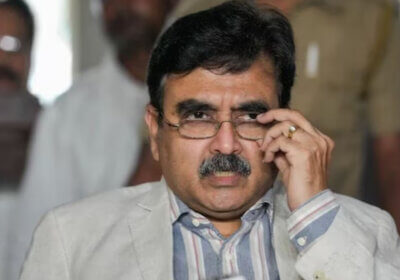

Justice AM Sapre, a former justice of the Supreme Court, presided over the panel.

Although SEBI was given a deadline of two months to submit a report, on Wednesday it was given an extension until August 14 to complete its investigations. Political controversy over the deadline extension followed SEBI’s filing of an affidavit claiming that reports that the Adani Group has been under investigation since 2016 (an argument asserted by some opposition leaders) are “factually baseless.”

After the report’s release, nine out of ten Adani Group stocks experienced gains.

Shocking allegations in the Hindenburg report

After shocking allegations in the Hindenburg report caused the market value of the Adani Group to drop by more than $100 billion, sparking a major political uproar and raising concerns about the Indian stock market as a whole, the Supreme Court charged the panel in March with looking into potential regulatory failures and making recommendations for reforms for investor protection.

After protests and demands for thorough investigations into the allegations made by Hindenburg Research, as well as denials linking prime minister Narendra Modi and Adani, opposition parties brought Parliament to a standstill during a significant portion of the Budget Session.

The Adani Group has refuted every claim made by Hindenburg Research

The Adani Group has refuted every claim made by Hindenburg Research and has been putting the finishing touches on a comeback plan that includes the $2.6 billion fundraising plan made public this month.

Related Read | Supreme Court Gives A Deadline To SEBI For Adani-Hindenberg Investigation

Pingback: Adani Criticized the Hindenburg Report